tn vehicle sales tax calculator knox county

Then subtract any trade-in credit from this total. The current total local sales tax rate in Knox County TN is 9250.

This tax does not apply to trailers.

. Vehicle Sales Tax Calculator. Lynchburg TN 37352 Phone. Heres the formula from the Tennessee Car Tax Calculator.

The average cumulative sales tax rate in Knoxville Tennessee is 925. There is a 3600 wheel tax in Knox County for all motorized vehicles and cycles. Knox County Sales Tax Rates for 2022.

James L Jimmy Poss. Please Select a County. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Tennessee local counties cities and special taxation.

Springfield TN 37172. Enter the values below and click Calculate. Know what your tax refund will be with FreeTaxUSAs free tax return calculator.

KNOX COUNTY WHEEL TAX. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales. Total vehicle sales price 25300 25300 x 7 state general rate 1771 Total tax due on the vehicle 1851 Clerk negotiates check for 1771 TN sales tax paid by dealer if.

Hours of Operation8am-430pm M-Fri. Vehicle Sales Tax Calculator. Blountville TN 37617.

732 S Congress Blvd Rm 102. Tennessee has a 7 sales tax and Knox County collects an additional 275 so the minimum sales tax rate in Knox County is 975 not including any city or special district taxes. 511 South Brown Street.

Knox County in Tennessee has a tax rate of 925 for 2022 this includes the Tennessee Sales Tax Rate of 7 and Local Sales Tax Rates in Knox. Plus additional title and registration fees. PLUS 15 to 275 Local Tax on the first 1600 of the purchase.

Easily E-File to Claim Your Max Refund Guaranteed. Gallatin TN 37066. Ad Calculate Your 2022 Tax Return 100.

Smithville TN 37166. The Hamilton County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Hamilton County local sales taxesThe local sales tax consists of a. Knox County TN Sales Tax Rate.

Our Knox County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. 7 State Tax on the sale price minus the trade-in. Knoxville is located within Knox County.

Vehicle Sales Tax Calculator. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Tennessee local counties cities and special taxation. To determine your taxable amount add together all fees on your bill of sale except Gap Insurance Finance Charges and Sales Tax.

This includes the rates on the state county city and special levels. There are exemptions from the Wheel. The December 2020 total local sales tax rate was also 9250.

2023 Fees Great Smoky Mountains National Park U S National Park Service

Tennessee County Clerk Registration Renewals

Knox County Tennessee Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Tennessee Vehicle Sales Tax Fees Calculator Find The Best Car Price

10listens In God We Trust License Plate Questions Answered Wbir Com

Tennessee County Clerk Registration Renewals

3 Sales Tax Holidays In Tennessee Wate 6 On Your Side

/cloudfront-us-east-1.images.arcpublishing.com/gray/DGDTWA76IVAQHEX5KGFPCU3FXQ.jpg)

Three Sales Tax Holidays Coming Soon In Tennessee

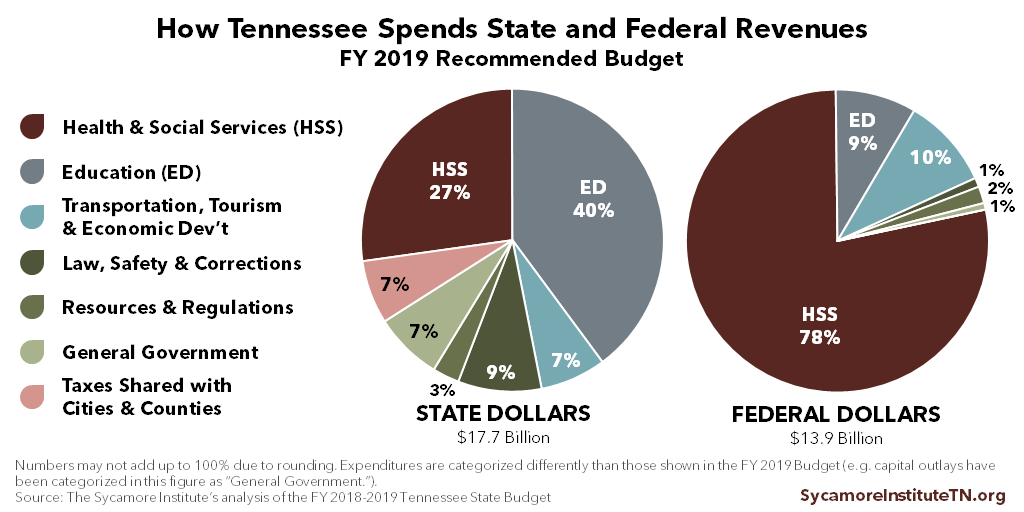

Tennessee Budget Primer The Sycamore Institute

4802 Brown Gap Rd Knoxville Tn 37918 Realtor Com

County Clerk Jefferson County Government

History Of Knoxville Tennessee Wikipedia

Tennessee Sales Tax Rates By City County 2022

Used Cars For Sale In Knoxville Tn Under 6 000 Cars Com

Knox County Commissioners React To Overcrowding In Jail Wbir Com

Lutton Buuck Win Knox County Public Defender Law Director Elections

Proposed Knox County Budget Includes No Property Tax Increase