does wyoming charge sales tax on labor

If you do not file your sales tax return within 30 days of the due date of. In Cheyenne for example the county tax rate is 1 for Laramie County.

Wyoming Clarifies Taxability Of Professional Services Avalara

Wyoming has a 4 state sales tax with counties adding up to an additional 3 resulting in a maximum rate of 7.

. All charges for materials and labor that you bill to your customer for any repair maintenance or installation project including any expenses or. Wyoming charges a 4 sales tax to its people. You then collect state sales tax plus any local tax from your customer on the amount you charge for the materials.

Your charge for the materials must be at least as much. Businesses must collect the special excise taxes on top of the sales tax rate of 4 percent. Wyoming has a statewide sales tax rate of 4 which has been in place since 1935.

The state-wide sales tax in Wyoming is 4. The Excise Division is comprised of two functional sections. Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from.

The state sales tax rate in Wyoming is 4. An example of taxed services would be one which sells repairs alters or improves. Wyoming Use Tax and You.

The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. The state of Wyoming does not usually collect sales taxes on the vast majority of services performed. Do you charge sales tax on labor.

Whether labor is subject to sales tax depends upon the circumstances under which the labor is performed. Use Tax By State. Sales Tax By State.

State wide sales tax is 4. Excise Taxes By State. You must read the following.

There are additional levels of sales tax at local jurisdictions too. Wyoming does not have an individual income tax. If you register for your sales tax permit the state will.

Beer and malt beverages. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200. Wyoming charges a late fee that is equal to 10 of the total late sales tax as well as a 1000 late fee.

If tangible personal property is not transferred labor is not. Labor unions and workers organizations are exempt from taxation on dues and other. All labor on both tangible and intangible property are taxable however.

Wyoming also does not have a corporate income tax. In addition Local and optional taxes can be assessed. The taxes are as follows.

You can look up the local sales tax rate with TaxJars Sales Tax Calculator. In Wyoming there are currently no statutory provisions to impose sales or use taxes on professional services provided that they do not include any sales of or repairs. How much does it cost to register for a Wyoming sales tax permit.

Wyoming charges 60 to register a new business sales tax permit but nothing to renew an existing one. Many states encourage the timely or early filing of sales and use tax returns with a timely filing discount. Do I need a.

Wyoming has a destination-based sales tax system so you have to pay. As of December 2019 the Wyoming DOR offers a discount of 195 on the first. Groceries and prescription drugs are exempt from the Wyoming sales tax.

County Sales Tax Rates. But how you will file this sales tax is the question in your mind.

Sales Taxes In The United States Wikipedia

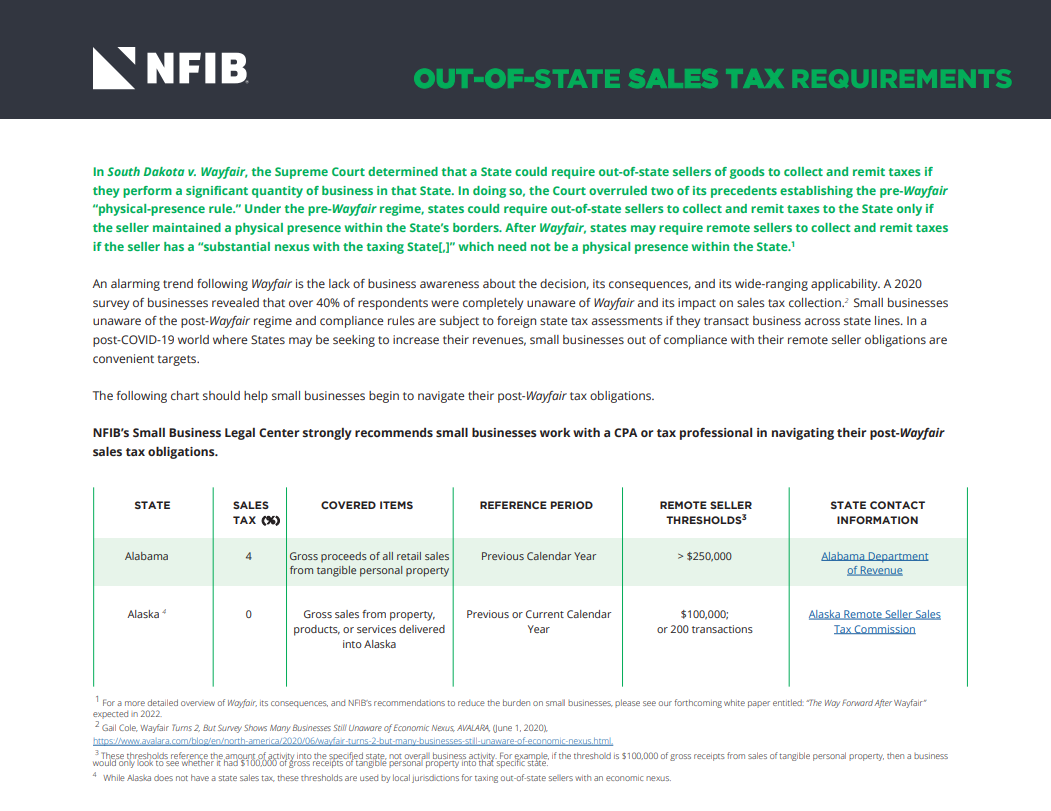

Tax Prep Overview Out Of State Sales Tax For Small Business

State Sales Tax Rates 2022 Avalara

State Gross Receipts Tax Rates 2021 Tax Foundation

How Much Does Your State Rely On Sales Taxes Tax Foundation

Sublette Examiner Wyoming Winds

A Complete Guide To Wyoming Payroll Taxes

Wyoming Changes Sales Tax Rules For Remote Sellers

How To Charge Your Customers The Correct Sales Tax Rates

What Transactions Are Subject To The Sales Tax In Utah

Sales Taxes In The United States Wikipedia

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

What Transactions Are Subject To The Sales Tax In Kentucky

How Do State And Local Sales Taxes Work Tax Policy Center

2022 2023 Michigan Labor Law Poster State Federal Osha In One Single Laminated Poster

Sales Tax By State In Which States Is Gift Wrapping Taxable Taxjar